what is a provisional tax code

It is income tax paid in advance during the year because of the way you your company or your trust earns its income. Youll have to pay provisional tax.

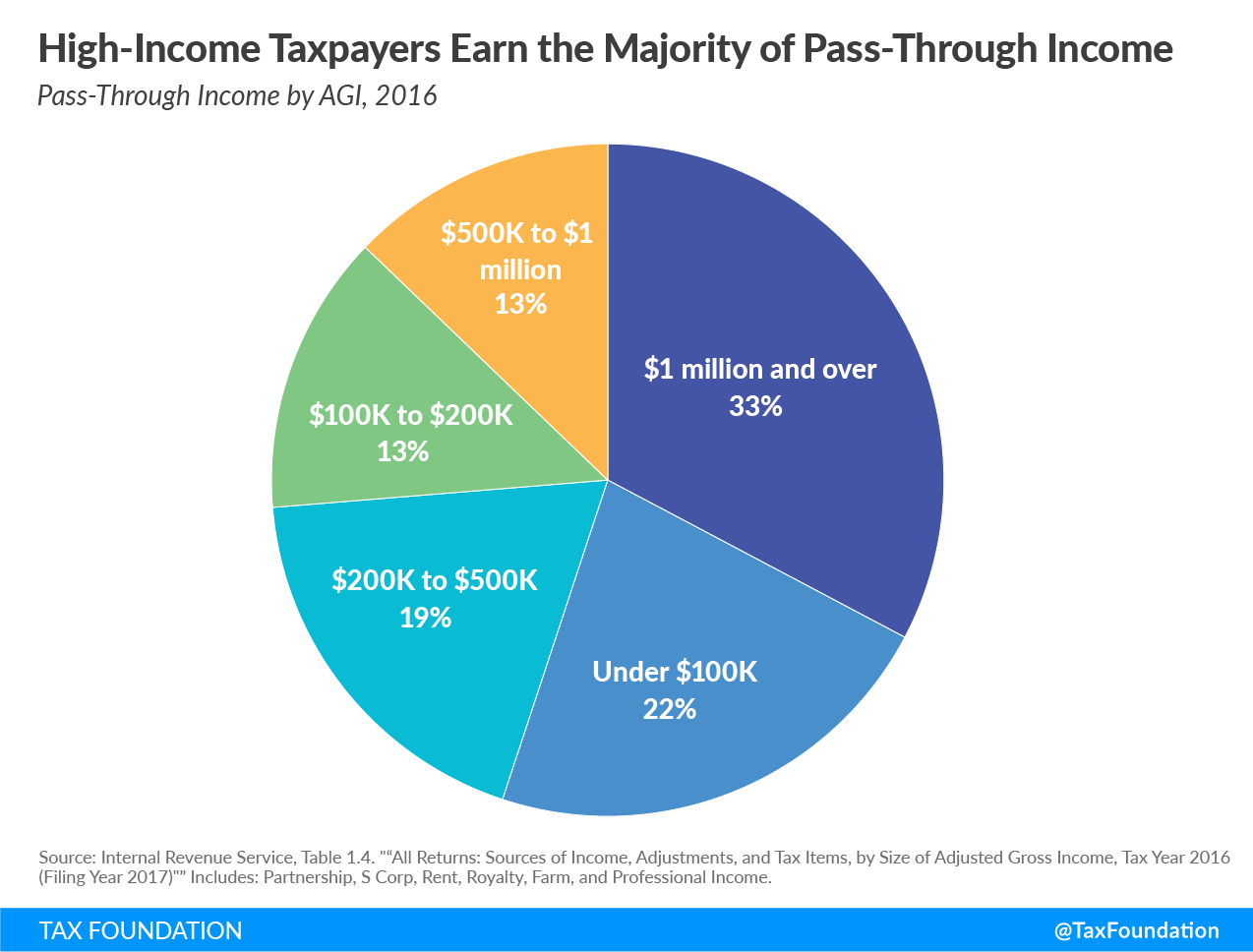

What Is A Pass Through Business How Is It Taxed Tax Foundation

Natural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives.

. Your provisional income is a. What Is A Provisional Tax Code. What Is Provisional Tax IRP6 IRP6 is the abbreviation used for the provisional return completed by the taxpayer to declare their estimated taxable income for the.

Look carefully on your IRP5 certificate to find it. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the. At the end of the year if a taxpayers actual tax.

Add this to 21000 to get a total of 28500. What is provisional tax. Provisional tax is not a special separate type of tax but simply a mechanism to pay your taxes during the tax year instead of having a large amount due to SARS on assessment.

Provisional tax is not a separate tax from income tax. What Is A Provisional Tax Code. This obligation to pay provisional tax can arise in addition to the taxpayers employer deducting tax from salary payments.

Natural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives. What Is A Provisional Tax Code. What is a provisional tax code.

Provisional tax can be explained as an advance payment made to offset against the Income Tax Liability for the respective year of assessment. Provisional taxes are tax payments made throughout an income year. Provisional tax is required from taxpayers by the government to pay part of the coming years tax in advance.

According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the previous. You pay it in instalments during the year instead of a lump sum at the end of the year. Provisional tax is not a separate tax.

Generally speaking the Inland Revenue Department will make an. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on. Provisional tax helps you manage your income tax.

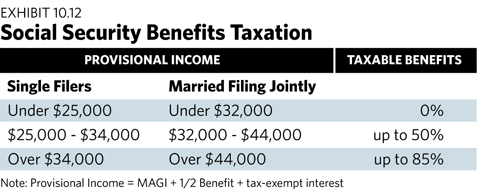

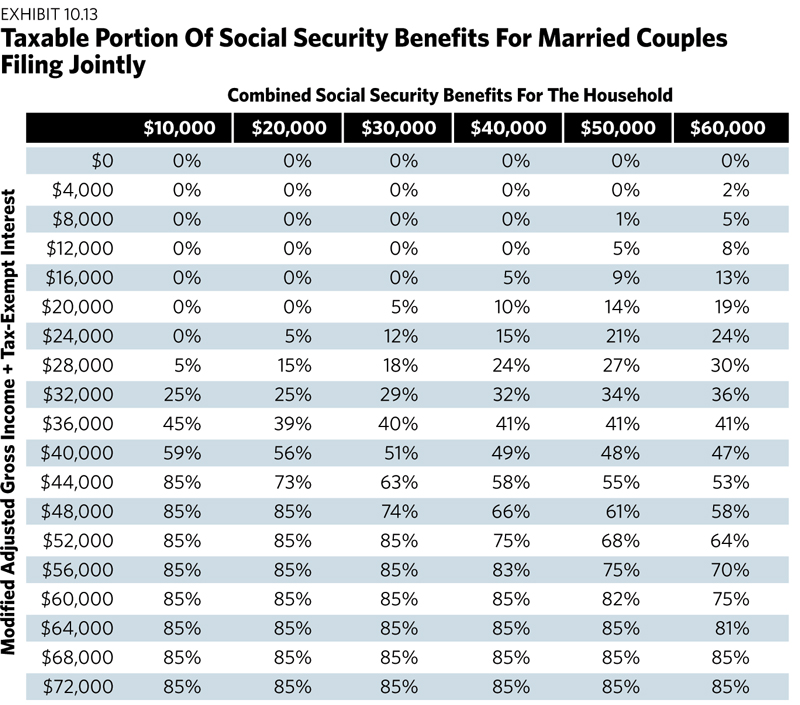

Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits. 27 January 2016. Natural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives.

This assists taxpayers in. Provisional tax payments are due if you have a March balance date and use the ratio option. They go towards the tax payable on income with no tax credits attached.

Provisional income is a threshold set by the IRS and Social Security benefits are taxed if they exceed the set amount. Provisional tax is not a separate tax.

Avoiding The Social Security Tax Torpedo

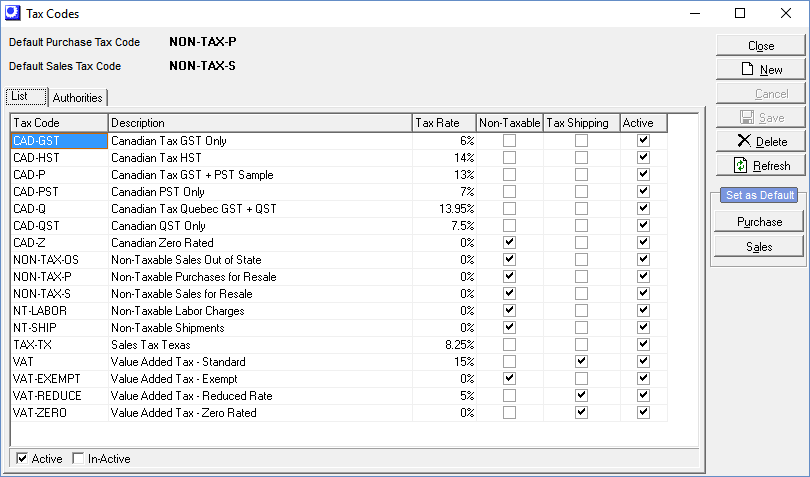

Fiji Revenue And Customs Service Pay All Your Taxes Through Online Banking Here S How Payment Type Provisional Tax Contractors 5 Reference Number Format Tin Tax Code Tax Year

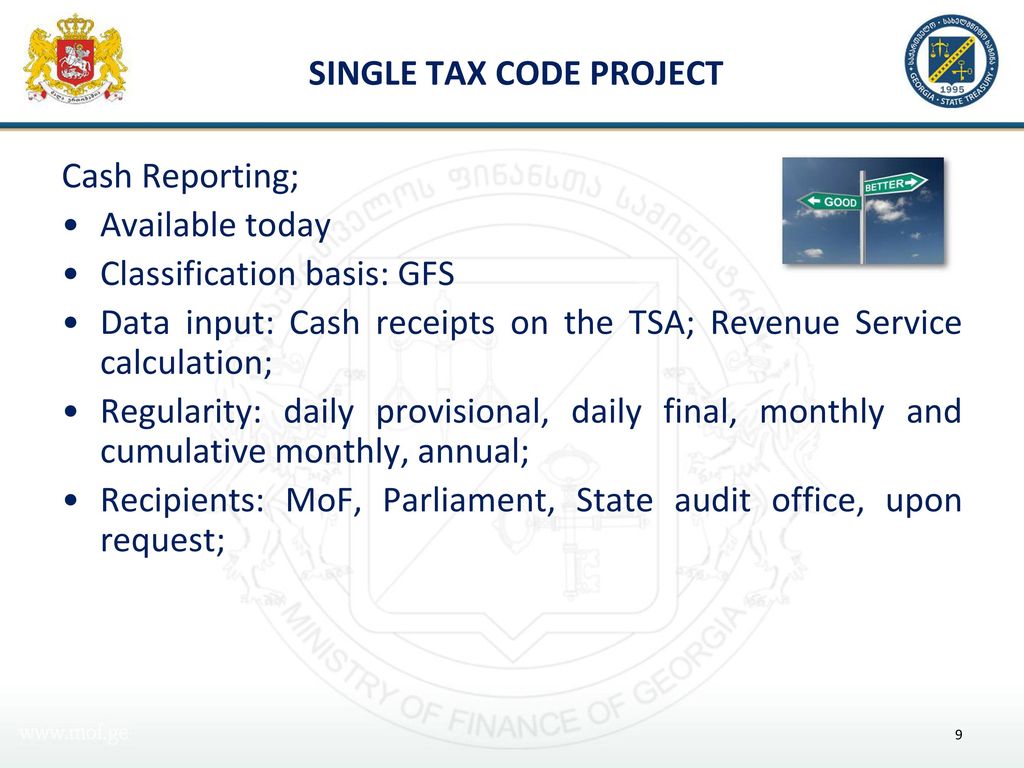

Single Tax Code Project Ppt Download

What Is The Difference Between The Statutory And Effective Tax Rate

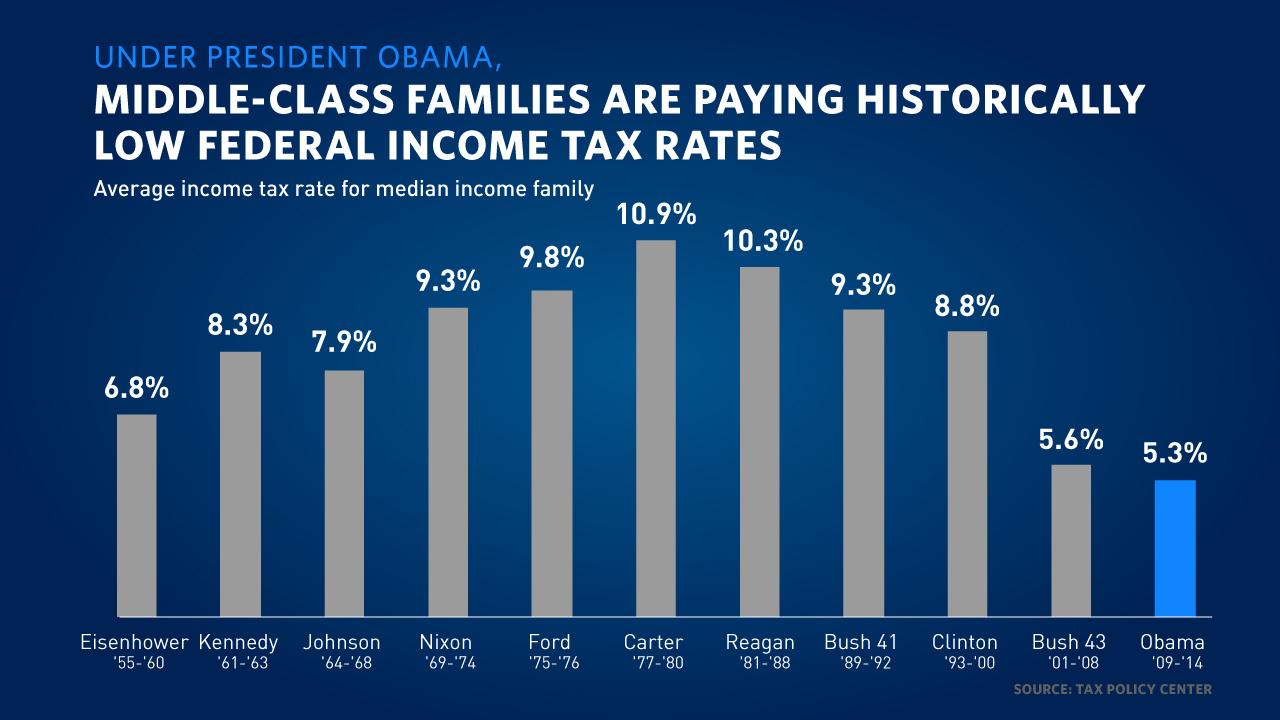

Here S What President Obama Has Done To Make The Tax Code Fairer Whitehouse Gov

Taxes On Social Security Social Security Intelligence

Nonprofit Law In China Council On Foundations

Digital Signature For Provisional Tax Letters

Part 3 Income Tax And Provisional Tax

Digital Signature For Provisional Tax Letters

Taxation In South Africa Wikipedia

United States What Tax Code Is Used For Tax Refunds Personal Finance Money Stack Exchange

What Is A Provisional Taxpayer Tax 101 Youtube

Avoiding The Social Security Tax Torpedo

Fiji Revenue And Customs Service Make Tax Payments To Us Via Online Banking Here S How Payment Type Income Provisional Tax Reference Number Format Tin Tax Code Account Code

Potato Tax Ri14a Provisional Booklet Of 24 Purple On Pink Cover Mint Vf Ebay